Dental Anesthesia Market Size And Share

The market size of global dental anesthesia reached USD 1.88 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.2% from 2023 to 2030. Anesthetics are chemicals that can produce reversible loss of sensation. Anesthetics are usually administered to assist the operation. The vasoconstrictors utilized in the US include epinephrine and levonordefrin. Epinephrine-containing dental anesthetics are prilocaine, bupivacaine, lidocaine, and articaine. Dental anesthetics market are applied to the inner gum or cheek before any dental surgery.

Increasing incidence of dental issues will propel the dental anesthesia market. The dental anesthetics market will grow tremendously in the coming years due to increased disposable incomes and increased oral consciousness. Dental anesthetic is expected to gain popularity in emerging countries such as China, India, and Brazil in the coming years due to their increasing incomes and comparatively higher DMFT indices (decayed, missing, and filled teeth index).

World demand for dental anesthetics is expected to increase due to the increasing rate of cancer, periodontitis, and gingivitis. It is also expected that the use of cigarettes and tobacco will grow, and eating habits will shift, which will further contribute to the growth in maxillofacial and oral dental ailments. The market for dental anesthesia is anticipated to develop as a result of the increasing frequency of dental caries and tooth decay around the world, rising public awareness of the value of oral health, and government efforts to improve access to dental care.

COVID-19 has affected all the markets including the dental industry as there was a complete lockdown imposed by the government as a precautionary measure. The supply chain for dental anesthesia was also affected. The pandemic has caused a huge disruption in the supply chain of the overall medical device industry. Due to international constraints, there was a reduction in dental procedures in 2020 and 2021, which had a negative effect on the market due to the coronavirus outbreak. The demand for dental anesthetics is expected to increase in the forecast period based on increasing dental care awareness and changing demographics.

Type Insights

On the basis of the type segment, the dental anesthesia market is divided into local, general, and sedation. Local dental anesthesia will lead the dental anesthesia market in terms of revenue with a market share of 52.8% in 2022. The most common type of anesthesia is a local anesthetic. Less complex treatments, like filling a cavity, that are less time-consuming and generally less complicated are treated with a local anesthetic.

In the majority of cases, it is the most secure option and also has minimal adverse effects, thus is used most preferably. From the eighteenth century, clinical dentists have used local anesthetics to minimize or abolish the pain that comes with invasive treatments. Oral and maxillofacial surgery also frequently utilizes local anesthetics. Dental practitioners most often use local anesthetics (LAs).

End-use Insights

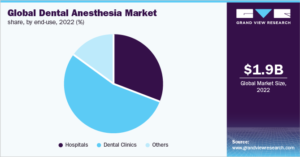

On the basis of end use, the dental anesthesia market is divided into dental clinics, dental hospitals, and others. The dental clinic end-use segment held the highest share of 53.7% in 2021. Increasing numbers of dental offices globally and the extensive use of advanced dentistry by small as well as large dental practices are the major drivers driving the dental clinics segment growth. It is also anticipated that the growing number of dental clinics, particularly in developed nations, will drive the growth of the market. Depending on the region, public healthcare offers dentists in industrialized countries sufficient remuneration for their services and treatments.

Regional Insights

Asia Pacific led the dental anesthesia market with a 38.6% market share in 2022 and is anticipated to exhibit a high CAGR during the forecast period. This is attributed to the growing incidence of dental issues among children and adult population and growing awareness for oral health.

APAC is anticipated to register the maximum CAGR of 5.7% between the forecast years due to favorable government policy, high population, and presence of well-developed healthcare facilities within these nations. Dentists in highly populated countries such as China and India recommend dental implants quite often to cover missing natural teeth, which are gaining popularity. These countries also have a heavy burden of dental and oral diseases, which is creating higher demand for periodic dental visits and checkups. Moreover, China and India are now the largest producers and consumers of tobacco with the lowest awareness regarding smoking dangers. These are the factors that are expected to drive the dental anesthesia market in the region.

Key Companies & Market Share Insights

There are small and large companies in the highly competitive international market for dental anesthesia. These organizations have adopted vital business strategies such as joint ventures, strategic alliances & collaborations, product innovation, new product launches, and contracts to bolster their market position and expand their market share.

One of the primary reasons driving competition among industry players is the fast development of technology in the advanced dentistry sector. For example, Septodont launched the Dentapen electronic syringe dental anesthetic in November 2018. Furthermore, many companies are collaborating with one another to develop innovative technologies for advertising their products at a faster rate. The European market leaders, like DENTSPLY and Septodont, are facilitating the increasing demand for better quality healthcare and products, which will continue to drive the growth of the dental anesthesia market.