The size of the global battery market was USD 134,622.4 million in 2024 and is expected to grow at a CAGR of 16.4% from 2025 to 2030. Growing demand for electric vehicles (EVs) is one of the key drivers for the growth of the market.

Furthermore, the increasing use of renewable energy sources in power grids is expected to increase the demand for batteries during the forecast period.

Solar and wind energy are intermittent in nature, and efficient energy storage solutions are needed to provide a stable and reliable supply of electricity. Batteries, particularly grid storage batteries, are vital in making renewable energy effectively utilisable.

Technologies like flow batteries and solid-state batteries are finding increasing popularity among renewable energy systems because of their scalability and longevity, helping shift towards a greener energy mix.

Growing consumer electronics market is also driving battery market demand. Penetration of smartphones, laptops, wearable technology, and IoT-compatible gadgets is making smaller, lightweight, and power-sustained batteries a must-have. Lithium-ion tech rules this segment yet, with incessant advancements creating new chemistry for lithium-sulfur and zinc-air batteries promising better performance in next-gen electronic devices.

Additionally, the growth of industrial automation and equipment electrification is propelling battery use in industries like manufacturing, logistics, and healthcare. Forklifts, robots, drones, and medical equipment are increasingly dependent on battery solutions for increased efficiency and mobility. As industries transition to cleaner and more flexible energy systems, demand for industrial-grade batteries is expanding rapidly, driving market growth.

Material Insights On the basis of material, the market is divided into lithium-ion, lead acid, nickel-based, small sealed lead-acid batteries, sodium-ion, flow batteries, and others.

Among the various materials, lithium-ion batteries emerged as the largest segment in the global battery market, capturing a significant market share of more than 44.0% in 2024. Lithium-ion batteries are rechargeable batteries that are widely used in consumer electronics, electric vehicles (EVs), and energy storage systems.

End Use Insights On the basis of end use, the market is divided into automobiles, consumer electronics, grid-scale energy storage, telecom, power tools, military & defense, aerospace, and others.

The automobile segment has become the biggest end use in the world battery market, accounting for more than 31.0 % of the market share in 2024.

Application Insights Segmented on the basis of application, the market can be divided into automotive batteries, industrial batteries, and portable batteries. The market for industrial batteries was the leading application worldwide, holding a market share of more than 35.0% in 2024.

These batteries are used in heavy-duty sectors, such as data centers’ backup power, grid-scale energy storage, and powering heavy equipment in industries like manufacturing, telecom, and logistics.

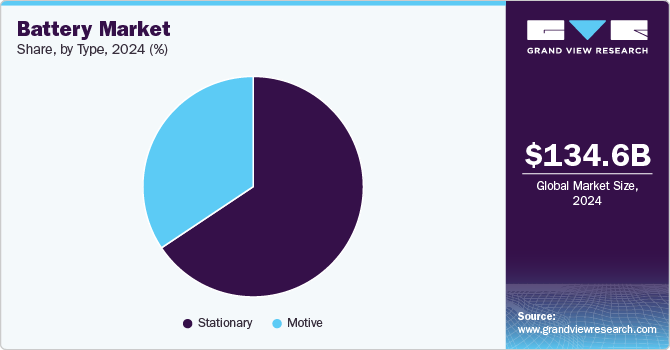

Type Insights

On the basis of type, the market is divided into motive and stationary segments. The stationary batteries segment was the largest in the world, holding more than 65.0% of the market share in 2024. This segment continues to dominate the market. Stationary batteries are intended for fixed, non-mobile uses and are mainly applied for energy storage and backup power. They are typically utilized in uninterruptible power supply (UPS) systems, renewable energy storage, telecommunications, and grid energy storage.

Key Insights for Battery Companies

The battery industry competitive landscape is evolving and fueled by aggressive technological innovations, rising need for renewable energy storage, and growing use of electric vehicles (EVs). Established players and emerging startups lead the way in innovation in solid-state and other new battery technologies. Competition is heightened by incentives for clean energy and sustainability from governments, triggering R&D investments and manufacturing capabilities.

Green Li-ion, a technology firm focused on recycling lithium-ion batteries, in April 2024 released the opening of its first North American commercial-scale facility to generate sustainable, battery-grade materials.

The plant, located inside a current recycling building, will make useful battery-grade cathode and anode material from concentrated parts of used-up batteries using Green Li-ion’s proprietary Green-hydro-rejuvenation technology.

On April 2024, Shenzhen Yongxinlong New Energy Technology Co., Ltd. released new lithium-ion rechargeable batteries for electric vehicles.

High-rate discharge performance refers to the cell’s discharge capacity, measured at a current of 0.2 C and a cut-off voltage of 2.5 V after a normal charge.